Fast international payments have become the backbone of global commerce in 2025. Founders are no longer asking if they should embrace faster cross-border solutions; they’re asking how soon.Yet the industry is still surrounded by outdated myths. These myths hold back entrepreneurs, slow down payroll, and chip away at growth opportunities.

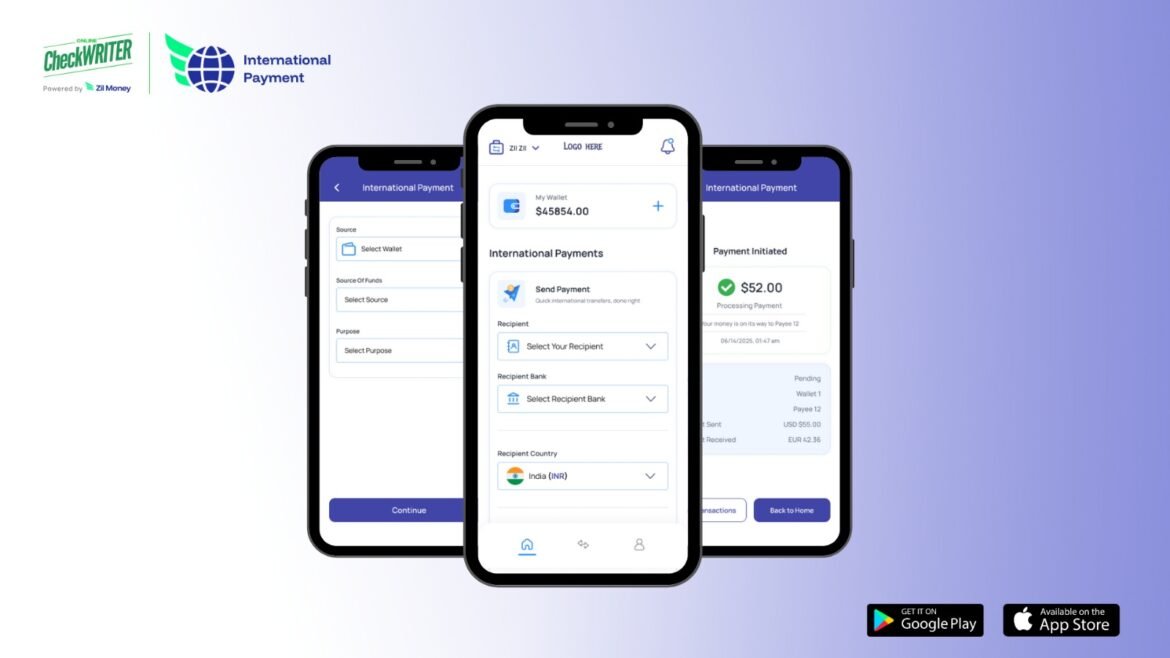

With the launch of the new mobile app from OnlineCheckWriter.com – Powered by Zil Money, those myths can finally be left behind.

Myth 1: “International payments always take days.”

Reality: The old belief that cross-border payments take three to five business days is no longer true. Global commerce moves too fast for outdated rails. International transfers are forecasted to increase 5% annually until 2027, and businesses need to keep up.

The mobile app enables founders to make Payments move faster, work gets delivered quicker, and growth becomes seamless.

Myth 2: “Hidden fees are impossible to avoid.”

Reality: Every founder has opened a payment confirmation only to see a number that doesn’t match the invoice. That lack of transparency erodes trust and complicates budgeting.

With B2B virtual cards recording 13% year-over-year spend growth, cost transparency is no longer optional—it’s essential. The new app solves this by showing exchange rates and total fees upfront. No fine print. No guesswork. Founders know exactly what leaves their account and what arrives on the other side.

Myth 3: “Payroll for remote teams is complicated.”

Reality: Hiring globally should be empowering, not intimidating. Remote work has become the standard, with 35.5 million people working remotely in Q1 2024—up 5.1 million from the year before. That shift means payroll must keep up.

The app simplifies payroll by enabling direct payments to remote staff in their local currency. Founders can pay a developer in Brazil, a designer in the Philippines, or a marketer in London straight from their phone—no more complex wires or juggling multiple providers.

Myth 4: “Tracking payments across borders is a nightmare.”

Reality: Few things frustrate founders more than sending money abroad and then being left in the dark. No updates. No visibility. Just anxiety.

But as the global virtual card market grows from $19.02 billion in 2024 to $60.06 billion by 2030, tracking features have become standard. The mobile app includes built-in tracking and digital records, giving founders clarity on every payment. Instead of chasing down suppliers or refreshing dashboards endlessly, every transaction is logged and easy to review.

Myth 5: “Only large companies can afford efficient global payments.”

Reality: For years, fast and efficient cross-border transfers were viewed as perks reserved for big corporations. Smaller players had to deal with delays and steep costs.

That era is gone. With B2B virtual card payments expected to reach $14.6 trillion by 2029, smaller businesses are competing globally—and winning. The mobile app is mobile-first, cost-friendly, and built to scale. Founders gain the same level of control and efficiency that enterprises enjoy, without gatekeeping.

A Founder’s Perspective

- A digital studio in New York pays freelance designers in Manila instantly, avoiding costly project delays.

- A Los Angeles apparel brand sends payments to textile suppliers in India without funds getting eaten up in hidden fees.

- An Austin SaaS startup onboards a London-based marketing team, confident every payroll cycle will be smooth.

For these founders, fast international payments aren’t just a convenience. They’re a credibility builder, a way to protect partnerships, and a growth enabler in a global market that never sleeps.

The Thought Leadership Takeaway

Speed in payments isn’t only about technology—it’s about business resilience. When funds move without friction, employees stay motivated, suppliers remain loyal, and expansion becomes borderless.

The new mobile app from OnlineCheckWriter.com – Powered by Zil Money finally delivers the clarity, control, and confidence founders need to thrive in international markets.

It’s time to act!

The myths are broken. Global payments no longer have to be slow, complicated, or weighed down by hidden costs.

Download the app today from the App Store or Google Play Store and make fast international payments your competitive edge in 2025.

FAQs

Q1. Is pre-funding required?

No ,not at all. The app does not require any pre-funding to be activated.

Q2. Can the app handle both supplier payments and payroll?

Yes. Whether paying vendors abroad or managing payroll for remote teams, the app simplifies every step.

Q3. Are there hidden fees in transfers?

No. Exchange rates and total costs are always shown upfront, so businesses can plan with confidence.