Looking for funding for your startup means creating a pitch deck that captures investor attention in minutes. Your presentation becomes the gateway between your business idea and the capital needed to scale it. Most founders struggle with crafting decks that balance compelling storytelling with the hard data investors demand.

The difference between securing meetings and facing rejection often comes down to including the right elements in the right sequence. Investors evaluate hundreds of pitch decks monthly, making first impressions critical to advancing in the funding process. Understanding what investors look for in each slide can transform your fundraising timeline from months to weeks.

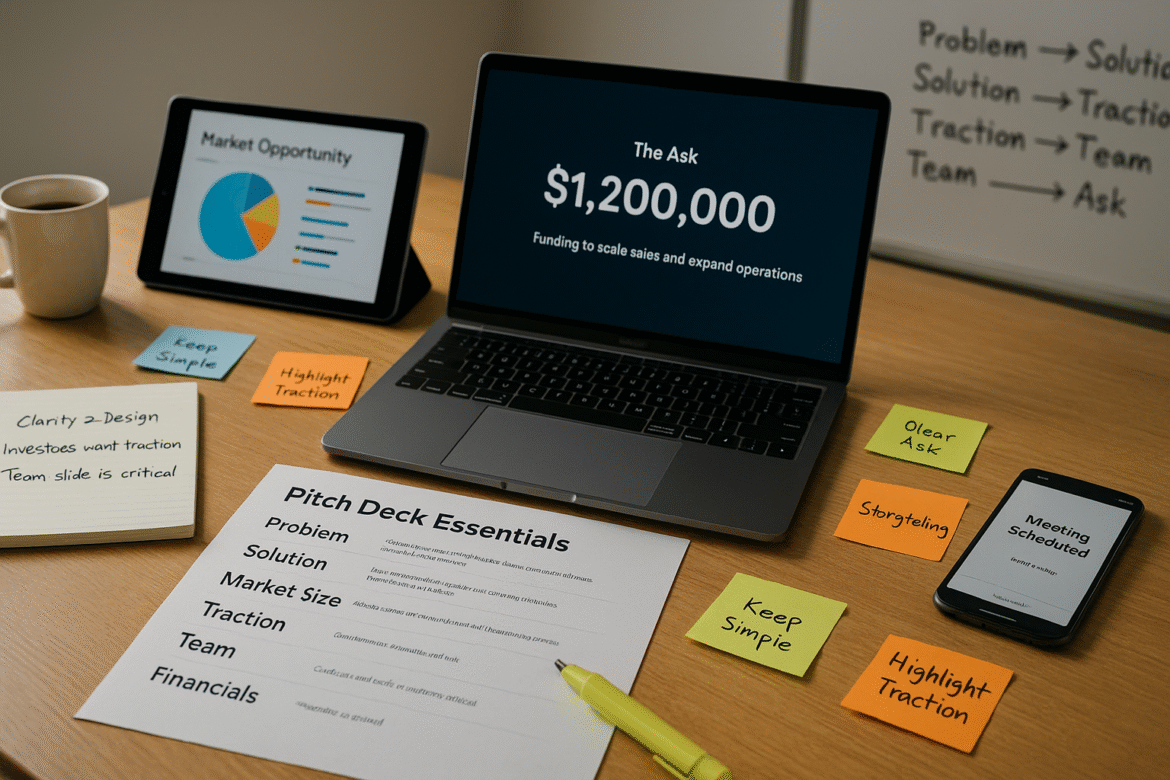

A well-structured pitch deck serves as your business blueprint, demonstrating market opportunity, execution capability, and growth potential. The following guide breaks down each essential component that separates funded startups from those still searching for investment.

What Is a Pitch Deck

A pitch deck is a brief presentation that provides investors with an overview of your business plan, products, services, and growth traction. Unlike comprehensive business plans that span dozens of pages, pitch decks condense your startup’s story into 10-20 slides designed for quick consumption and decision-making.

Pitch decks differ from business plans in their focus on visual storytelling and key highlights rather than detailed operational procedures. While business plans serve as internal roadmaps for execution, pitch decks function as external marketing tools for securing investment interest and initial meetings.

Common presentation formats include email attachments for cold outreach, live presentations during investor meetings, and demo day presentations at accelerator programs. Each context requires slight modifications in slide count and detail level, but core components remain consistent across all formats.

Why Investors Rely on a Business Deck

Pitch decks help investors quickly evaluate investment opportunities and filter through hundreds of proposals they receive monthly. The standardized format allows investors to compare startups across similar criteria, making initial screening more efficient and systematic.

In the due diligence process, pitch decks serve as conversation starters that identify promising opportunities worth deeper investigation. Investors use decks to assess founder communication skills, market understanding, and business model viability before committing time to detailed financial analysis and reference calls.

The visual format enables investors to grasp complex business concepts rapidly, while the constrained slide count forces founders to prioritize their most compelling value propositions. This efficiency benefits both parties by accelerating the matching process between suitable investors and fundable startups.

To deepen your understanding of what investors scrutinize on each slide, Fincrat provides a detailed breakdown, covering everything from problem-solution fit and validated market opportunity to realistic financials and a solid team slide.

Slide-By-Slide Pitch Deck Components That Secure Funding

1. Title and Mission Slide

Your title slide establishes first impressions through company name, logo, tagline, and one-sentence mission statement. This slide sets the professional tone for your entire presentation and demonstrates attention to detail that investors notice immediately.

Include your company’s legal name, website URL, and founder contact information for easy follow-up. The tagline should capture your core value proposition in five words or fewer, while the mission statement clarifies your company’s purpose and target impact.

Professional design elements on this slide signal operational competence and brand awareness. Investors often judge presentation quality as a proxy for execution capability, making visual consistency crucial from slide one.

2. Problem Slide

The problem slide articulates the specific pain point your startup solves, making the issue relatable and urgent for investors to understand. Focus on problems that affect large market segments and create measurable friction or costs for potential customers.

Quantify the problem’s scope through market research, customer surveys, or industry reports that demonstrate widespread impact. Personal anecdotes or customer testimonials add emotional weight to statistical evidence, helping investors connect with the human element behind market opportunities.

Avoid generic problem statements that apply to multiple industries. Instead, identify specific workflows, processes, or experiences that your target customers find frustrating, expensive, or time-consuming in their current state.

3. Solution Slide

Present your product or service as the clear answer to the stated problem, emphasizing your unique value proposition and competitive differentiation. Connect directly to the pain points identified in the previous slide, showing how your approach eliminates or reduces customer friction.

Focus on core functionality rather than exhaustive feature lists that may overwhelm investors with technical details. Highlight what makes your solution distinctly better than existing alternatives, whether through cost reduction, time savings, improved outcomes, or enhanced user experience.

Include proof points such as early customer feedback, beta testing results, or comparative analysis that validates your solution’s effectiveness. These evidence points build credibility for your claims about product-market fit and customer satisfaction.

4. Market Opportunity Slide

Cover total addressable market (TAM), serviceable addressable market (SAM), and target customer segments with specific sizing data and growth projections. Use bottom-up analysis based on customer research rather than top-down estimates from broad industry reports.

Market sizing approaches should combine multiple data sources including industry analysis, competitor benchmarking, and direct customer interviews. Growth potential indicators include regulatory changes, technology adoption trends, or demographic shifts that expand your addressable market over time.

Identify early adopter segments within your broader market that demonstrate highest willingness to pay and fastest adoption cycles. These segments become your beachhead for initial traction before expanding to adjacent customer groups.

5. Product Demo Slide

Showcase your product through screenshots, mockups, or demo videos that highlight user experience and core functionality. Visual demonstrations prove product existence and development progress beyond conceptual ideas or wireframes.

Focus on user interface elements that address the core problem identified earlier, showing clear before-and-after workflows that demonstrate value creation. Keep demonstrations simple and intuitive, avoiding complex feature explanations that distract from primary benefits.

For software products, show actual user interfaces rather than marketing renderings. For physical products, include prototype images or manufacturing samples that prove feasibility and design progression toward market-ready versions.

6. Business Model Slide

Explain revenue streams, pricing strategy, and how your company generates income through clear monetization approaches. Cover whether you use subscription models, transaction fees, advertising revenue, or direct sales to create predictable income flows.

Detail your pricing strategy relative to customer value creation and competitive alternatives. Include information about customer acquisition costs, lifetime value calculations, and unit economics that demonstrate sustainable profitability potential.

Address scalability factors such as marginal costs, operational leverage, and growth constraints that affect your business model’s long-term viability. Investors evaluate whether your model can support the returns their fund requires within typical investment timeframes.

7. Go-To-Market Slide

Detail customer acquisition strategies, sales channels, and marketing approaches that explain how you plan to reach and convert target customers. Include specific tactics for each customer segment you identified in the market opportunity section.

Essential elements of a pitch deck include demonstrating deep understanding of customer acquisition costs and conversion metrics across different channels. Provide early evidence from pilot programs, partnerships, or initial sales efforts that validate your go-to-market assumptions.

Explain your sales process timeline from initial customer contact to closed deals, including key milestones and conversion rates at each stage. This operational detail helps investors assess execution risk and capital requirements for scaling customer acquisition.

8. Competitive Landscape Slide

Cover direct and indirect competitors, competitive advantages, and market positioning through comparison charts or competitive matrices that provide clear differentiation. Include both established players and emerging startups that target similar customer needs.

Identify your sustainable competitive advantages such as proprietary technology, exclusive partnerships, network effects, or regulatory barriers that protect market position. Avoid claiming “no competition” since this suggests limited market validation or founder market blindness.

Position your company within the competitive landscape rather than claiming superiority across all dimensions. Acknowledge areas where competitors excel while highlighting specific advantages that matter most to your target customers.

9. Traction Slide

Present evidence of business momentum including user growth, revenue milestones, partnerships, and key achievements that demonstrate product-market fit progression. Focus on metrics that validate both customer demand and business model effectiveness.

Include month-over-month growth rates, customer retention statistics, and usage metrics that prove engagement beyond initial adoption. Partnership announcements, pilot program results, and customer testimonials provide additional validation of market acceptance.

Highlight inflection points in your traction metrics that correlate with product improvements, marketing initiatives, or strategic decisions. These insights demonstrate learning velocity and operational competence that investors value in early-stage companies.

10. Financials Slide

Cover revenue projections, key financial metrics, and unit economics with clear assumptions behind growth forecasts and path to profitability. Present three-year projections that balance ambitious growth with realistic market constraints.

Include key performance indicators specific to your business model such as customer acquisition cost, lifetime value, gross margins, and cash flow timing. These metrics help investors model potential returns and assess capital efficiency.

Explain major assumptions driving your financial projections including market penetration rates, pricing evolution, and operational scaling factors. Transparent assumption-sharing builds credibility and enables productive discussions about growth scenarios.

11. Team Slide

Highlight founder backgrounds, relevant experience, and key team members who bring domain expertise and execution capability to your startup. Focus on accomplishments and skills directly relevant to your market and business challenges.

Include previous startup experience, industry expertise, technical capabilities, and network connections that provide competitive advantages. Mention advisors or board members who add credibility and strategic value to your team composition.

Address any obvious gaps in team expertise and your plans for filling key roles through hiring or advisory relationships. Investors evaluate team completeness as a risk factor that affects execution probability.

12. Funding Ask Slide

State your specific funding amount, use of funds breakdown, and key milestones the investment will achieve within your projected timeline. Be clear about equity offered and funding timeline expectations for closing the round.

Provide detailed allocation of investment proceeds across hiring, product development, marketing, and operational expenses. Connect spending categories to specific milestones such as product launches, market expansion, or revenue targets that demonstrate progress toward the next funding round or profitability.

Include information about current funding status, committed investors, and timeline for closing the round. This context helps investors understand urgency and competitive dynamics in your fundraising process.

Metrics and Traction Investors Need to See

Quantitative proof points demonstrate business momentum through customer acquisition metrics, retention rates, and revenue growth indicators that build investor confidence in your startup’s trajectory and market validation.

Key metrics vary by business model but should always include customer acquisition costs, lifetime value ratios, and growth sustainability indicators. Monthly or weekly tracking demonstrates operational discipline and data-driven decision-making that investors expect from fundable teams.

SaaS metrics include:

- Monthly Recurring Revenue (MRR): Demonstrates predictable income growth and customer value creation over time

- Churn Rate: Measures customer retention and product stickiness across different user segments

- Customer Lifetime Value (CLV): Quantifies long-term revenue potential per customer acquisition investment

Marketplace metrics include:

- Transaction Volume: Shows platform usage growth and economic activity between marketplace participants

- Take Rate: Demonstrates monetization effectiveness and pricing power within the ecosystem

- Network Effects: Measures how platform value increases with additional users or transactions

E-commerce metrics include:

- Conversion Rates: Indicates website effectiveness and customer purchase intent across traffic sources

- Average Order Value (AOV): Shows customer spending patterns and upselling success over time

- Repeat Purchase Rates: Demonstrates customer satisfaction and brand loyalty development

Financial Projections and Funding Ask That Build Credibility

Realistic financial forecasts and structured funding requests demonstrate financial sophistication and strategic thinking that investors require for serious consideration. Projections should extend three years with detailed assumptions about market penetration, pricing evolution, and operational scaling.

Common projection timeframes include monthly detail for year one, quarterly detail for year two, and annual projections for year three. Key assumptions should address customer acquisition rates, retention patterns, pricing changes, and competitive responses that affect growth trajectories.

Valuation expectations should align with comparable company analysis and funding stage benchmarks. Over-optimistic valuations signal market inexperience while under-pricing suggests lack of confidence in business potential.

| Stage | Typical Amount | Key Focus Areas | Investor Types |

| Pre-seed | Under $1M | Product development, initial traction | Angels, micro VCs |

| Seed | $1M-$5M | Product-market fit, early growth | Seed funds, strategic angels |

| Series A | $5M-$15M | Scaling operations, market expansion | VCs, growth funds |

Storytelling and Design Best Practices for a Great Pitch Deck

Narrative flow, visual design principles, and presentation techniques keep investors engaged throughout your pitch by creating logical progression from problem identification through investment opportunity. Structure your deck as a compelling story arc that builds toward your funding ask.

Professional design consistency reinforces credibility while clear visual hierarchy guides investor attention to key information. Avoid design elements that distract from core messages or create cognitive load that reduces comprehension.

1. Keep One Idea Per Slide

Slide clarity prevents information overload that causes investor attention to drift during presentations. Each slide should advance one specific point in your overall narrative rather than cramming multiple concepts into limited visual space.

Complex concepts require distillation into digestible presentations that busy investors can process quickly. Use supporting appendix slides for detailed information that interested investors can review during follow-up conversations.

Title each slide with the key takeaway rather than generic labels like “Competition” or “Market.” This approach ensures clarity even when slides are reviewed independently from live presentations.

2. Use Data-Driven Visuals

Charts, graphs, and infographics support key points more effectively than text-heavy slides that require extensive reading during presentations. Visual storytelling enables immediate comprehension of trends, comparisons, and relationships within your data.

Choose chart types that emphasize your most important insights such as growth trajectories, market comparisons, or customer segmentation analysis. Avoid complex visualizations that require explanation to understand basic meaning or conclusions.

Label all axes, include data sources, and highlight the specific insight each visual supports. Raw data without context provides little value to investors evaluating investment opportunities across multiple companies.

3. Maintain Consistent Branding

Color schemes, fonts, and design elements reinforce company identity throughout your presentation while building professional credibility with potential investors. Consistent branding suggests attention to detail and operational competence that extends beyond slide design.

Limit color palettes to three primary colors that reflect your brand identity and ensure readability across different presentation environments. Font choices should prioritize clarity over creativity, with consistent sizing hierarchy that guides visual attention.

Logo placement, spacing, and visual elements should follow established brand guidelines that extend to other company materials. This consistency suggests marketing sophistication and brand awareness that investors value in consumer-facing businesses.

4. Close With a Clear Next Step

End presentations with specific calls-to-action and follow-up processes that move interested investors toward due diligence conversations. Avoid generic statements about “looking forward to hearing from you” that provide no clear direction.

Request specific meeting types such as partner meetings, due diligence sessions, or term sheet discussions based on investor feedback during your presentation. Include your contact information and expected timeline for follow-up communication.

Prepare for common questions about valuation, use of funds, or competitive threats by having appendix slides ready for deeper discussion. This preparation demonstrates thoroughness and anticipation of investor concerns.

Common Pitch Deck Mistakes Founders Should Avoid

Frequent errors damage funding prospects through presentation mistakes that can be easily corrected with proper preparation and investor perspective understanding. These mistakes signal inexperience or poor judgment that raises execution risk concerns.

1. Overloading Slides With Text

Dense text reduces presentation effectiveness by creating cognitive load that prevents investors from following your verbal narrative. Slides should support rather than duplicate your spoken presentation through visual reinforcement of key points.

Condense information into bullet points that highlight essential takeaways rather than complete sentences that compete with verbal delivery. Each bullet should communicate one specific insight or data point that advances your overall argument.

Practice delivering your presentation with slides that contain minimal text to ensure your verbal narrative carries the primary information load. Slides serve as visual anchors for complex concepts rather than reading materials.

2. Hiding Weaknesses Instead of Addressing Them

Acknowledge risks and competitive threats directly rather than hoping investors won’t identify obvious challenges during due diligence. Transparency builds trust while demonstrating strategic awareness that investors expect from experienced founders.

Present mitigation strategies for identified risks such as competitive responses, regulatory changes, or market adoption challenges. This proactive approach shows strategic thinking and risk management capabilities that reduce investor concerns.

Address elephant-in-the-room issues such as limited traction, competitive threats, or team gaps early in discussions rather than allowing investors to discover problems independently. Controlled disclosure manages narrative framing around challenging topics.

3. Ignoring Competitive Threats

Downplaying competition damages credibility by suggesting either market ignorance or intentional misdirection that investors will discover during research. Position against competitors honestly while highlighting specific advantages that matter to customers.

Research includes both direct competitors offering similar solutions and indirect competitors that customers currently use to address the same problems. Understanding competitive alternatives validates market existence and customer willingness to pay.

Explain why customers would switch from existing solutions to your offering through specific value propositions that justify switching costs and adoption effort. Generic superiority claims lack credibility without supporting evidence.

4. Using Unfounded Market Numbers

Common market sizing errors include top-down estimates that lack connection to actual customer behavior or willingness to pay for your specific solution. Validate market opportunity claims through bottom-up analysis based on customer research.

Unrealistic projections suggest poor judgment or market inexperience that raises execution risk concerns among investors. Ground market size estimates in addressable customer segments and realistic penetration assumptions.

Research methodologies should combine industry reports, competitor analysis, and direct customer interviews that validate both market size and customer acquisition potential. Multiple data sources increase credibility of market opportunity claims.

How Many Slides Should a Pitch Deck Be

Optimal deck length varies by presentation context, with different formats requiring specific slide counts and detail levels. Email decks prioritize brevity while live presentations allow more comprehensive coverage of key topics.

Email pitch deck guidelines:

- 10-12 slides maximum: Ensures complete review within limited attention spans for cold outreach

- Focus on core value proposition: Emphasizes problem, solution, market, and team without excessive detail

- Clear call-to-action: Requests specific meeting type and includes contact information for follow-up

Live presentation guidelines:

- 15-20 slides with appendix: Allows comprehensive coverage with backup slides for questions

- Verbal narrative support: Slides anchor key points while founder provides detailed explanation

- Interactive discussion: Extra slides accommodate investor questions and deeper exploration

Demo day format guidelines:

- 3-5 minutes, 8-10 slides: Extreme time constraints require focus on highest-impact information

- Memorable hook: Opening must capture attention in competitive presentation environment

- Strong close: Clear funding ask and contact information for follow-up conversations

Tools and Templates for Writing a Pitch Deck Faster

Software platforms and resources streamline deck creation while helping founders build professional presentations efficiently. Modern tools reduce design time and provide structured templates that ensure comprehensive coverage.

1. AI-Powered Deck Builders

Platforms using artificial intelligence generate slide content and design suggestions based on industry best practices and successful funding examples. These tools particularly benefit non-designers who need professional visual presentation.

AI tools analyze your input text and suggest slide layouts, color schemes, and content organization that follows investor expectations. They reduce creation time while maintaining design quality that builds credibility.

Benefits include automated formatting, content suggestions, and design consistency that might require professional design services otherwise. However, customization remains important for brand differentiation and unique value proposition communication.

2. Design Marketplaces

Template libraries and professional design services provide cost-effective options for high-quality visual presentation that competes with professionally designed decks. These resources offer industry-specific templates and design elements.

Professional designers familiar with investor expectations create templates that incorporate best practices for slide layout, color selection, and information hierarchy. This expertise translates into higher-quality presentations without full custom design costs.

Access to diverse template options enables customization that reflects your brand identity while maintaining professional presentation standards. Quality templates provide structural foundation while allowing content personalization.

3. Data Room Integrations

Platforms connecting pitch decks with investor data rooms and fundraising workflows highlight efficiency benefits for investor outreach and follow-up management. Integration reduces administrative overhead during fundraising processes.

Automated tracking shows investor engagement with your materials while organizing follow-up communications and due diligence requests. This visibility helps prioritize investor relationships and timing for follow-up outreach.

Centralized document management ensures investors access current versions while maintaining confidentiality controls. Version control prevents confusion during multiple investor conversations and due diligence processes.

Accelerate Fundraising With Qubit Capital

AI-powered investor matching and data room creation streamline the fundraising process through technology that connects startups with relevant investors based on stage, sector, and investment criteria. The platform’s global network includes over 20,000 investor contacts across different stages and geographies.

Smart matching algorithms analyze startup profiles against investor preferences and portfolio focus to identify highest-probability funding sources. This targeted approach reduces outreach time while improving meeting conversion rates compared to broad-based investor outreach.

Data room support provides streamlined due diligence preparation and management that accelerates investor evaluation processes. Automated document organization and access controls reduce administrative burden while maintaining professional presentation standards.

Founders can leverage pitch deck services offered by Qubit Capital to enhance their presentations with professional design and strategic messaging that resonates with investors across different funding stages.

Benefits include:

- Investor Discovery: Access to over 20,000 global investor contacts with filtering by stage, sector, and geography

- Smart Matching: AI algorithms connect startups with relevant investors based on portfolio fit and investment criteria

- Data Room Support: Streamlined due diligence preparation and management for efficient investor evaluation

FAQs

How should a pitch deck change for angel investors versus venture capitalists?

Angel investor decks should emphasize founder story and market validation, while VC decks require more detailed financial projections and scalability metrics. VCs typically expect deeper competitive analysis and a clearer path to significant returns.

Where should an exit strategy slide go in an investor deck?

Exit strategy information belongs in the appendix or follow-up materials rather than the main presentation. Most investors prefer to discuss exit scenarios during due diligence conversations after initial interest is established.

How soon should founders follow up after emailing a pitch deck?

Wait one week before sending a polite follow-up email, then follow up every two weeks for up to six weeks total. Persistent but respectful communication demonstrates commitment without appearing desperate.

What file format works best for sharing an investor deck?

PDF format ensures consistent formatting across devices and prevents unauthorized editing. Include your company name and “Confidential” in the filename for professional presentation and basic security.